Must READ for KVB PO : GST (Goods and Service Tax)

Want to Become a Bank, Central / State Govt Officer in 2020?

Join the Most awarded Coaching Institute & Get your Dream Job

Now Prepare for Bank, SSC Exams from Home. Join Online Coure @ lowest fee

Lifetime validity Bank Exam Coaching | Bank PO / Clerk Coaching | Bank SO Exam Coaching | All-in-One SSC Exam Coaching | RRB Railway Exam Coaching | TNPSC Exam Coaching | KPSC Exam Coaching

Must READ for KVB PO : GST

(Goods and Service Tax)

Tomorrow will not be the same as India is going to see a change in the tax system with the introduction of the new Goods and Service Tax. In recent days there was a huge buzz about the rates being reduced and increased as per the public opinion and the tax structure for various products was released.

The tax structure in India is not uniform and it differs from state to state, the government hopes to change the existing tax structure with the introduction of the GST. So come lets further learn more about the GST and it’s different tax rates for various products.

What is GST ?

Goods & Service Tax is comprehensive , multistage and destination based tax that will be levied on every value addition. It is a unified indirect tax across the country on products and services. In the current system, tax is levied at each stage separately by the Union government and the States at varying rates, on the full value of the goods.

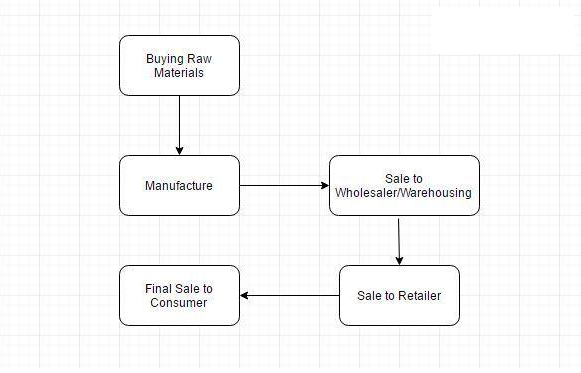

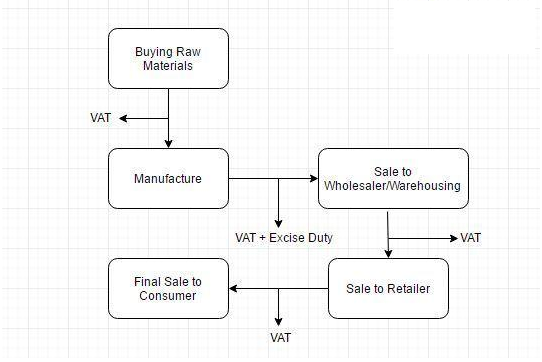

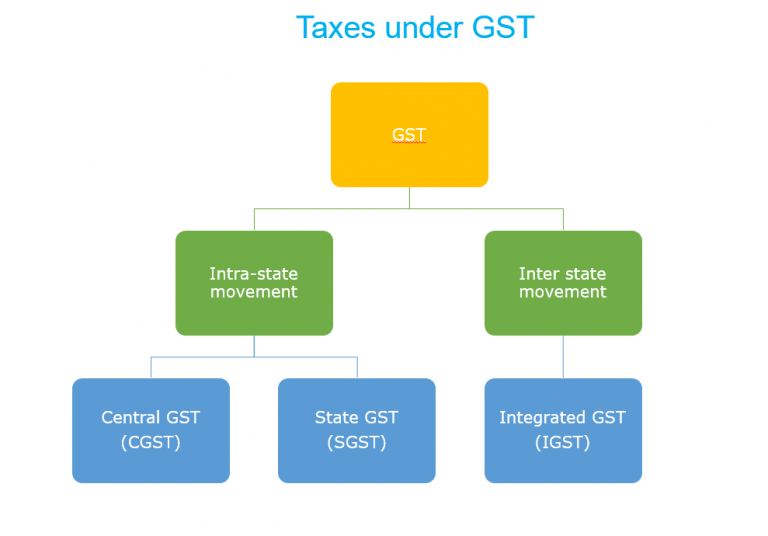

These diagrams will provide you a clear picture about GST.

So tax is levied on every stage of the goods production and the consumer will bear the end product’s tax. Also this a destination based tax , which means for example , if a product is manufactured in place X , the tax for the manufactured product goes to “X” and if the manufactured product is sold in city “Y” , then the tax obtained through the sale will go to city “Y”. The diagram clearly explains the various VAT levied at the production of the various products.

WHY GST should be implemented ?

- Indian tax payers pay two types of taxes , they are direct taxes and indirect taxes. In direct taxes the liabilities cannot be passed on to someone else, but in indirect taxes the liabilities can be passed on to others like the end user.

- A clear example for the direct tax is the income tax paid by the individual. In indirect taxes the seller sells a product to the consumer and the consumer pay the marked price of the product along with VAT to the seller. But the seller have already paid the tax for the product to the government and this is actually a plus to the seller as they are gaining again from a VAT which the consumer pay and the buyer pays the tax additionally.

This type of indirect taxes will be regulated in the new GST regime from July 1 ,2017.

What taxes will the GST replace ?

GST will replace the taxes the existing Central taxes like

- Central Excise duty

- Additional Duties of Customs (commonly known as CVD)

- Special Additional Duty of Customs (SAD)

- Service Tax

GST will also replace the existing state taxes like

- State VAT

- Central Sales Tax

- Entertainment and Amusement Tax (except when levied by the local bodies)

- Taxes on lotteries, betting and gambling

How many States have ratified the law?

As of date, all States and Union Territories, barring Jammu and Kashmir, have endorsed their respective State Goods and Services Tax (SGST) Act. While West Bengal and Kerala took the ordinance route, other State Assemblies ratified the law.

What are the types of GST ?

CGST: The revenue will be collected by the central government

SGST: The revenue will be collected by the state governments for intra-state sales

IGST: The revenue will be collected by the central government for inter-state sales

What are the different GST rates ?

The different types of GST rates are 5%, 12%, 18%, 28%.

| Tax Rates | Products |

| 5% | Edible oil, sugar, spices, tea, coffee (except instant)Coal (instead of current 11.69%)

Mishti/Mithai (Indian Sweets) Life-saving drugs |

| 12% | Computers, Processed food |

| 18% | Hair oil, toothpaste and soaps (currently at 28%)Capital goods and industrial intermediaries (big boost to local industries) |

| 28% | Small cars (+1% or 3% cess)Consumer durables such as AC and fridge

Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) High-end motorcycles (+15% cess) Beedis are NOT included here |

Will GST be a definite game changer of the tax paying system ? We don’t have an answer, but we hope the aspects of this goods and service tax should be known to the public fully for better implementation of the taxes.

Will this change the way of paying taxes for different products ? Absolutely yes. But we have to wait for sometime to see the real success of any system. As this Goods and Service tax was speculated to be introduced for a long time. We hope this should will not bring much hassles to present taxation system.

Please Click the below links to know about the IBPS Study Planner & Banking Awareness Quiz & an article on GST