THE HINDU EDITORIAL 5, July – 2017

THE HINDU EDITORIAL 5, July – 2017

A) INTERMISSION

Taxes are of two kinds. A progressive tax can be an instrument of state policy, yielding benefits for the many at the expense of a few. But a tax can also be debilitating. A higher rate can sometimes be counterproductive, restricting the growth of the sector, and eventually resulting in lower revenues. With the introduction of the Goods and Services Tax, the Tamil Nadu film industry is squeezed on every side; in protest, cinema halls across the State have downed their shutters indefinitely. What is hurting is not the 28% GST on tickets priced above ₹100, or even the 30% levy imposed by local bodies as entertainment tax, but the fact that these come on top of the existing State government-imposed cap on ticket rates. The cap of ₹120 means that the exhibitors might earn more from their lease of cinema space to popcorn vendors than from screening the film. Indeed, given the differential rates, the exhibitor might not be able to earn much more from charging ₹120 for a ticket than he could from charging ₹99. Increasing tax rates while maintaining an overall price cap makes no sense at all. Governments are free to not incentivise certain services or forms of consumption. However, in this case, the end result of the squeeze on the margins of exhibitors and distributors is making the entire film industry unviable. The price cap on tickets was sought to be justified on the ground that otherwise there would be exploitative premiums charged on keenly awaited films during the early days of their release, when demand runs high. It was believed that this protected members of fan clubs of popular film stars, most of whom are from the lower social strata. But with the piling up of different taxes, it is the exhibitors who are at the wrong end of the exploitation. Although some Tamil films qualify for exemption from entertainment tax, on account of their ‘social messaging’, such certification depends all too often on pulling the right political strings. In an industry where politicians of every hue are involved, tax exemption has been open to widespread abuse. Local bodies have not earned much from entertainment tax, but what the government loses in terms of revenue, the party in power gains in terms of power and influence over the film industry. Given that the GST rates cannot be altered, being fixed nationally, the sensible solution is to give up the price cap on tickets and reduce the entertainment tax. Price caps on tickets have inhibited the building of new cinema halls in Tamil Nadu, even as old ones shut shop. Also, if the government’s true objective is to safeguard the interests of the filmgoer, then it must be ready to forego tax revenue. The lesson that Tamil Nadu needs to understand is that a high rate of taxation can be debility

B) OPEN TO CAPITAL

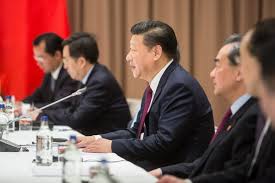

China opened itself to foreign investors on Monday by liberalising rules that regulate participation in its massive bond market. The new Bond Connect scheme, which was keenly awaited for months, allows large foreign investors such as banks and pension funds to buy and sell mainland Chinese bonds through offshore accounts in Hong Kong. China’s bond market, the third largest in the world, is estimated to be over $9 trillion in value and is expected to double in size over the next five years. Yet foreign investors own less than 2% of the overall bond market, thanks to China’s policy of raising significant barriers to the free entry and exit of capital. Further, its central bank, the People’s Bank of China, of late has been tightening monetary policy to squeeze out liquidity, which has, in turn, led bond yields in China to be higher than in many developed economies. So it was no surprise that investors rushed in to make use of the scheme to trade in Chinese bonds and later announced their entry. It is noteworthy that the present move to liberalise bond investment comes after the Chinese authorities took significant steps to ease the purchase of mainland stocks by foreign investors. The Shanghai and Shenzhen stock exchanges were connected to the Hong Kong stock exchange in 2014 and 2016, respectively, which allowed the entry of hundreds of Chinese stocks into international indices such as the MSCI. Chinese bonds can now expect similar international recognition. Bond Connect is a significant step in China’s march towards a more open capital account. First, the inflow of foreign capital will help Beijing control the yuan. In time, the scheme will boost the borrowing potential of the Chinese sovereign as well as of corporations, while improving bond market liquidity by offering access to a wider pool of international capital. The entry of more private capital into the Chinese economy can encourage investments in economic projects as well. Also, after the inclusion of the Yuan in the International Monetary Fund’s basket of currencies in 2016, the present bond reform gives a further boost to the Chinese currency. In the long run, greater participation of foreign investors in Chinese financial assets will increase the usage of the Yuan, and thus aid Beijing’s efforts to internationalise the currency. This trend will also help bring more stability to China’s financial markets, known for their high levels of volatility, by improving transparency and the quality of business practices. It is worth noting that currently about 70% of bonds in China have a maturity period of less than five years, and a quarter of less than one year, as investors are wary of the risks involved in lending money over longer periods. Going forward, the challenge for Chinese authorities lies in allowing free price discovery, which can lead to painful turmoil in the short run in its bond market. It will indeed be a test of whether they have learned the right lessons from the stock market crash of 2015.

WORDS/ VOCABULARY

1) Progressive tax

Meaning: A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term “progressive” refers to the way the tax rate progresses from low to high, with the result that a taxpayer’s average tax rate is less than the person’s marginal tax rate.

2) Debilitating

Meaning: making someone very weak and infirm.

Example: The debilitating effects of underinvestment.

Synonyms: Weakening, Enfeebling.

Antonyms: Restorative.

3) Squeezed

Meaning: Manage to get into or through a narrow or restricted space.

Example: We all squeezed into Steve’s van.

Synonyms: Restraint, Hold.

Antonyms: Release, Opening.

4) Levy

Meaning: An act of levying a tax, fee, or fine.

Example: Police forces receive 49 per cent of their funding via a levy on the rates.

Synonyms: Impose, Charge.

Antonyms: Demobilize, Disband.

5) Exhibitors

Meaning: A person who displays works of art or other items of interest at an exhibition.

Example: The event attracted many new exhibitors and proved fascinating for children and adults alike.

6) Vendors

Meaning: The seller in a sale, especially of property.

Example: Contracts between the vendor and the claimant were exchanged on 12th June 1995.

7) keenly

Meaning: In an eager or enthusiastic manner.

Example: One of this year’s most keenly anticipated movies.

Synonyms: Strongly, Vigorously.

Antonyms: Unenthusiastically.

8) Exemption

Meaning: The action of freeing or state of being free from an obligation or liability imposed on others.

Example: Vehicles that may qualify for exemption from tax.

Synonyms: Indemnity, Exclusion

Antonyms: Accountability, Liability.

9) Widespread

Meaning: Found or distributed over a large area or number of people.

Example: There was widespread support for the war.

Synonyms: General, Extensive.

Antonyms: Concentrated, Limited.

10) Inhibited

Meaning: Unable to act in a relaxed and natural way because of self-consciousness or mental restraint.

Example: I could never appear nude, I’m far too inhibited.

Synonyms: Reserved, Reticent.

Antonyms: Extroverted, Friendly.

11) Offshore

Meaning: Made, situated, or registered abroad, especially in order to take advantage of lower taxes or costs or less stringent regulation.

Example: A lot of corporates and individuals hold offshore accounts legitimately.

12) Indices

Meaning: Link the value of (prices, wages, or other payments) automatically to the value of a price index.

Example: The Supreme Soviet passed legislation indexing wages to prices.

13) Liquidity

Meaning: The availability of liquid assets to a market or company especially cash.

Example: A firm may be unable to pay unless it has spare liquidity.

Synonyms: Translucency, Lucidity.

14) Volatility

Meaning: Liability to change rapidly and unpredictably, especially for the worse.

Example: The succession of new rulers contributed to the volatility of the situation.

15) Turmoil

Meaning: A state of great disturbance, confusion, or uncertainty.

Example: The country was in turmoil.

Synonyms: Confusion, Upheaval.

Antonyms: Calm, Peace

Read Previous Editorial:

THE HINDU EDITORIAL – 4, July – 2017

THE HINDU EDITORIAL – 3, July – 2017